All about How To Form A Llc

Whether the LLC will be handled by its members or by managers. The person forming the LLC should sign the short articles, and in some states the registered agent must likewise sign. 6: File the Articles of Organization You need to submit the articles and a filing charge to your state's service filing company.

Processing times might differ from a couple of days to a couple of weeks, depending on your state. Some states offer expedited processing for an additional cost. You will receive a certificate when the LLC has actually been officially formed. 7: Release a Notice A few states have an additional requirement: you should publish a small paper notice of your intent to form an LLC.

There might be charges connected with this notice that have to be paid to the newspaper or to the state federal government. Contact your Secretary of State for the requirements in your state. 8: Banking, Licenses and Other Organisation Now that your LLC is main, you can obtain a federal tax ID number and set up a company savings account.

Examine This Report on How To Form A Llc

And if you are doing organisation in more than one state, you will need to sign up to do company in those additional states. Establishing an LLC isn't tough, but it's crucial to follow your state's requirements. And once your LLC is established, you'll have acquired essential defense on your own and your company.

Florida LLC Forms Foreign LLC Forms Submit online with a credit card. OR Total the fillable PDF form using your computer system. Print and sign it. Mail it to the Department of Corporations with the required payment. OR Print the PDF form. Total it using blue or black ink.

Mail it to the Department of Corporations with the necessary payment. Make all checks payable to the Florida Department of State. Examine and cash orders should be payable in U.S. currency drawn from a U.S. bank. Charge card accepted for filing online are Master Card, Visa, Discover and American Express.

Facts About How To Form A Llc Revealed

File online: Processed in the order received. File by mail: Processed in the order received. Back to Leading Back to Top.

"LLC Development" or "forming an LLC" is the process whereby you formally produce a separate company entity-- an official filing where you start an LLC at the state level. Depending on the state, this is accomplished by: Cleaning your LLC service name for approval by comparing it with existing LLC's on file.

Holding an Organizational Satisfying (which specifies who becomes a Member or Supervisor and issues owneship portion to the "owners") and adopting the LLC Operating Contract (the guidelines your LLC embraces for internal governance consisting of adding/removing members, managing disputes, etc.). Last Formalities: The LLC must then obtain a Federal Employer Recognition Number (also understood as an FEIN-- we can get this in your place) and then open a savings account so LLC company funds can be managed individually.

The Of How To Form A Llc

Forming an LLC is a clever action when beginning an organisation, mostly due to the fact that it safeguards the owner from business-related suits. The thought of forming an LLC might seem a little challenging, however we reveal you how to form one with our step-by-step guide. Unlike a LLC is a separate organisation entity.

Besides the liability protection, the Limited Liability Company provides a number of other advantages over the sole proprietorship, collaboration, and corporation because of the numerous tax alternatives, ease of administration and management versatility. The requirements to form an LLC are different by state. Below, we summarize the details most states require when forming an LLC.

Each state has various requirements for forming an LLC. Select your state to see how to form a Restricted Liability Company. The next action to arranging an LLC is to select an available company name for the LLC. There are numerous concerns in picking an LLC name: The name usually requires to end with "LLC," "Restricted Liability Company," or some permitted abbreviation thereof. The name needs to be distinguishable from all active foreign and domestic LLCs submitted with the Secretary of State (in California, you can do an initial search of LLC names on record at The name can't contain some terms that may be prohibited by state law (such as "bank," "trustee" or "insurer").

The smart Trick of How To Form A Llc That Nobody is Talking About

(to click over here guarantee that the LLC is not misconstrued as a corporation). i was reading this You require to do a hallmark search to guarantee you aren't breaching another party's trademark (check uspto.gov). Conduct a comprehensive Internet search on the proposed name to see if other business use of the name might trigger you problems.

Look at the schedule of getting the ". com" domain name related to the service (rather than ". org," ". web," or some other version). If you want to use a name other than your official LLC name publicly, then you may be needed to submit a "fictitious organisation name" declaration or "doing organisation declaration" (DBA).

For more suggestions on this, see 12 Tips for Identifying Your Startup Organisation. An LLC is formally formed when you prepare and file an "Articles of Organization" (a couple of states call this something else) with the Secretary of State. Here are some pointers on preparing the LLC Articles of Company: The Articles of Company tend to be brief and easy to finish.

How To Form A Llc Things To Know Before You Buy

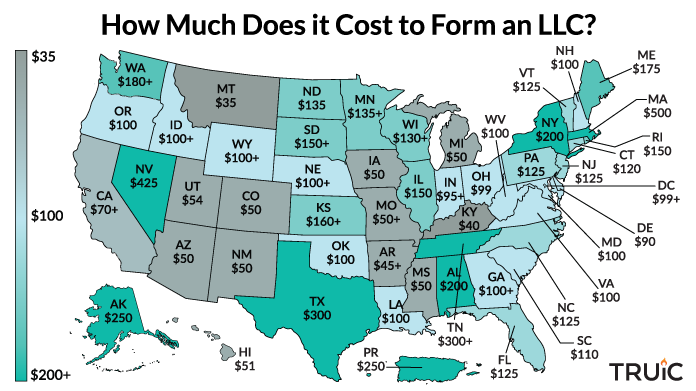

This can be a service business (such as CT Corporation or Legal Zoom) or an LLC member. You will need to pay a filing fee (generally around $100), and in some states a minimum annual tax (such as $800 in California). You require to consist of a declaration regarding the LLC's function (in California the wording is automatically stated in the form--"The function of the restricted liability company is to engage in any lawful act or activity for which a restricted liability business might be organized under the California Revised Restricted Liability Business Act").

For instance, see the sample Articles of Company in New York. The LLC Operating Arrangement states the owners' (called "members" in an LLC) financial, management, and other rights and responsibilities. Here are some crucial concerns that ought to be resolved in the LLC Operating Arrangement: What amount of capital contributions are made to the LLC by the parties, and when those contributions are required to be made Any charges or treatments if the capital contributions are not made How profits and losses are to divide and dispersed among the owners Whether any members or class of securities of the LLC have choices in distributions or on liquidation (akin to "preferred stock" in a corporation) Who will manage the LLC (a sole manager, a group of supervisors, or all of the members) How any officers will be designated Ballot rights for significant events like additional capital contributions or sale of the company Indemnification defense for the managers running business Limitations on transfer of LLC interests (the LLC interests are frequently described as "units") Treatments for meetings of the members Procedures for dissolution The majority of lawyers or online filing services have a basic form of LLC Operating Contract that you can customize to your specific situation If your LLC plans to raise cash from angel investors, household members, venture capital firms, or other financiers, take into account the following: Numerous investors, especially equity capital firms, prefer to buy corporations and not LLCs.

The financiers must be warned of the risks of the financial investment, and make representations and guarantees to the effect that they are sophisticated investors, are "recognized," that they understand the threats involved, and that they are prepared for the loss of their whole financial investment. The rights of the financiers (rights to revenues, distributions, tax benefits, voting rights, pre-emptive rights for future system issuances, and so on) need to be clearly stated in the LLC's Articles of Organization and/or in a financier rights contract.